how much is inheritance tax in oklahoma

How Much Is Inheritance Tax In OklahomaYou can also join us for a free seminar to. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Oklahoma Estate Tax Everything You Need To Know Smartasset

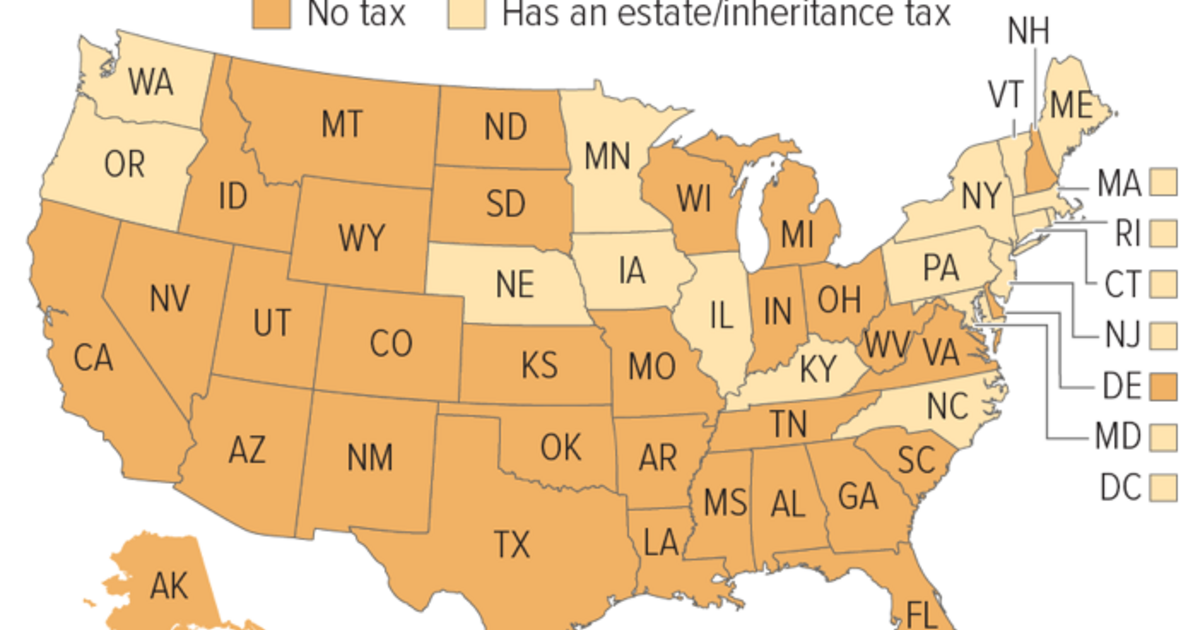

The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

. As of 2021 the six states that charge an inheritance tax are. I will be receiving inheritance of about 210000 how much or if any will be taxed in Oklahoma - Answered by a verified Tax Professional. However with a proper approach to estate planning you can easily reduce that taxable.

His practice focuses on estate planning probate real estate trust administration business. As a result if a persons estate is less than 5490000 and there are no other. In addition to the repeal of the estate tax the Oklahoma inheritance tax has an exemption amount of 5000000.

Who has to pay. Parman Easterday will explain the federal rules and advise you whether at your death or the death of a loved one from whom you are inheriting an estate tax return will need. These states have an inheritance tax.

Based on the value of the estate 18 to 40 federal estate. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. The current amount that requires federal taxes is any inheritance equal to or greater than 5490000.

Postic is an attorney at Postic Bates PC. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Inheritance tax rates differ by the state. Spouses are also completely exempt from the inheritance.

Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a. Get a FREE consultation. State inheritance tax rates range from 1 up to 16.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount. Oklahoma Income Tax Calculator 2021. The taxable part of your estate may be subject to up to a 40 federal estate tax rate.

There will be no tax due unless the. A few states have disclosed exemption limits for. As of 2021 only estates worth more than 117 million are taxed and only on the amount that exceeds that number.

The statewide sales tax in Oklahoma is 450. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. Your average tax rate is 1198 and your marginal.

Click the nifty map below to find the current rates.

Pin On Oklahoma Elections State Questions

Oklahoma Estate Tax Everything You Need To Know Smartasset

The Simplified Probate Procedure Oklahoma Probate Advance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Oklahoma Estate Tax Everything You Need To Know Smartasset

Estate Planning Attorney Estate Planning Estate Planning Attorney How To Plan

Organizers Medicaid Expansion Volunteers Break State Record With 313 000 Signatures Kfor Com Medicaid Health Care Insurance Organization

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Second Marriage Estate Planning Tulsa Estate Planning Kania Law

Do I Need To Pay Inheritance Taxes Postic Bates P C

Do I Need To Pay Inheritance Taxes Postic Bates P C

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Oklahoma Inheritance Laws What You Should Know Smartasset

Pin On Oklahoma Elections State Questions

State Taxes On Inherited Wealth Center On Budget And Policy Priorities