osceola county property tax estimator

You can now access estimates on property taxes by local unit and school district using 2020 millage rates. Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided.

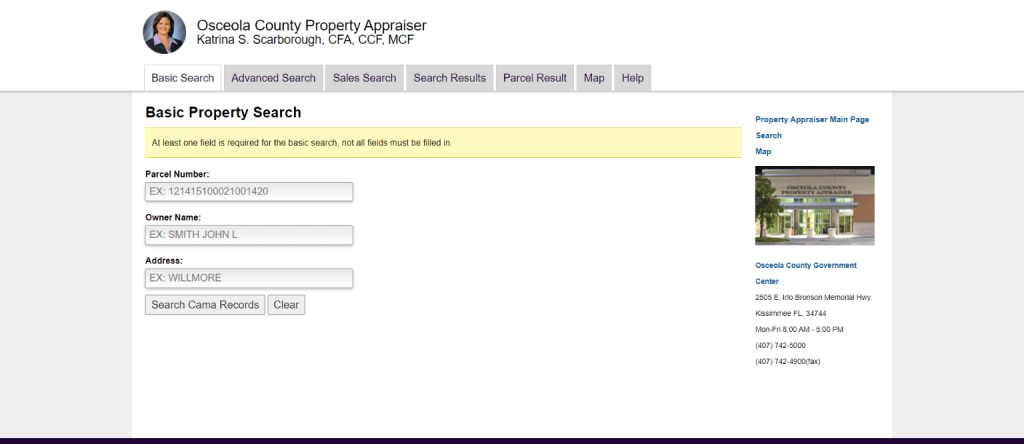

Property Search Osceola County Property Appraiser

14 the total of estimate taxes discounted 6.

. The median property tax on a 19920000 house is 189240 in Osceola County. Osceola County has one of the highest median property taxes in the United States and is. Osceola County collects very high property taxes and is among the top 25 of counties in the United States ranked by property.

Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. Learn all about Osceola County real estate tax. The median property tax on a 10110000 house is 106155 in the United States.

Minimum stamp tax on any conveyance having a total consideration of 100 or less 070 Deed shown as corrective or given to clear title but not in lieu of foreclosure 070 Deed given in lieu of foreclosure 070 per. Irlo Bronson Memorial Highway. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

The sales tax rate for Osceola County was updated for the 2020 tax year this is the current sales tax rate we are using in the Osceola County Florida Sales Tax Comparison Calculator for 202223. 407-742-3995 Driver License Tag. We enjoyed seeing everyone at the Silver Spurs Rodeo Parade in downtown City of St.

If this rate has been updated locally please contact us and we will update the sales tax rate for Osceola County Florida. OSCEOLA COUNTY TAX COLLECTOR. Tangible Department 2505 E Irlo Bronson Memorial Highway Kissimmee FL 34744.

You will then be prompted to select your city village or township along with your school district. Cloud Florida a couple of weeks ago. Effective March 30 2015 Class E Driving Skills Test offered at the Main Office of the Osceola County Tax Collector by appointment only.

The median property tax on a 19920000 house is 193224 in Florida. Parcel Number Owner Name Address. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Osceola County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections. The median property tax on a 19920000 house is 209160 in the United States. Payment due by June 30th.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. The median property tax also known as real estate tax in Osceola County is 73400 per year based on a median home value of 7020000 and a median effective property tax rate of 105 of property value. The following services are offered by the Property Appraisers Office.

Florida voters overwhelmingly approved a constitutional amendment Amendment 1 on January 29 2008 which grants added tax relief to property owners. When the consideration for real property includes property other than money the consideration is presumed to be equal to the fair market value of the real property. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Values used in the estimator are based on 2021 certified tax roll. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. The Osceola County seat can be found in the County Courthouse in Sibley. 407 742-5000 to arrange for a visit from our office to assist you with any exemption for which you are applying.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Under Florida law e-mail addresses are public records. Osceola County Florida Property Search.

Parcel Number Owner Name Address. No walk-ins will be accepted for driving skills test. Osceola County Florida Property Search.

Search all services we offer. This Tax Estimator is intended to assist homesteaded and non-homesteaded property owners estimate future taxes and understand the impact of amendments to the Florida State Constitution which affect real property assessments. Yearly median tax in Osceola County.

Visit their website for more information. The median property tax on a 10110000 house is 163782 in Michigan. Osceola County Property Appraiser Attn.

This estimator is based upon the following assumptions and mathematical variables. If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. If you need access to property records deeds or other services the Osceola County Assessors Office cant provide you can try contacting the Osceola County municipal government.

Scarborough CFA CCF MCF March 8 2022 507 pm. My team and I love connecting with the community and look forward to future parades. Sales tax in Osceola County Florida is currently 75.

The median property tax on a 10110000 house is 115254 in Osceola County. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

095 of home value. JANUARY 15 2015 - PHISHING. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

Osceola County Property Appraiser Katrina S.

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

Property Search Osceola County Property Appraiser

Osceola County Property Appraiser How To Check Your Property S Value

Property Tax By County Property Tax Calculator Rethority

Osceola County Fl Property Tax Search And Records Propertyshark

Agenda Tuesday March 15 2011 Osceola County School District

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

Florida Income Tax Calculator Smartasset

Osceola County Fl Property Tax Search And Records Propertyshark

Property Search Osceola County Property Appraiser

Property Search Osceola County Property Appraiser